The New Zealand housing market is easily influenced by a number of economic forces, which impact not only homeowners and investors, but have an effect on the real estate landscape in general. A rise in interest rates by the Reserve Bank can lead to shifts in mortgage payments and property sales. And while developers release new sections, housing supply and property values are directly affected.

While rates do play a major role, certain factors play their own important roles in regard to the real estate market. At Najib, we often assess the following factors when it comes to making market predictions; Average home prices, number of annual home sales, supply of inventory, mortgage rate, affordability, unemployment, inflation, and migration.

We closely monitor the economic factors that are at play, to help guide you through the complexities of the housing market, and assist you in the making of informed decisions. Here is a brief glimpse into the crucial markers that we’ve identified.

Interest Rates and Mortgage Holders

If the Reserve Bank of New Zealand raises interest rates, mortgage holders with rates below 6% could see mortgage payments increase. This could lead to an increase in the number of people selling their homes, which will result in an oversupply of housing inventory. As the Reserve Bank was slow to raise interest rates, I predict that they will be slow to lower it again as time goes on.

Development and Housing Supply

The fact that developers are still working on thousands of sections to be released will further contribute to housing supply, and will decrease property prices as buyers will have more options due to increased industry supply.

Unemployment and Inflation

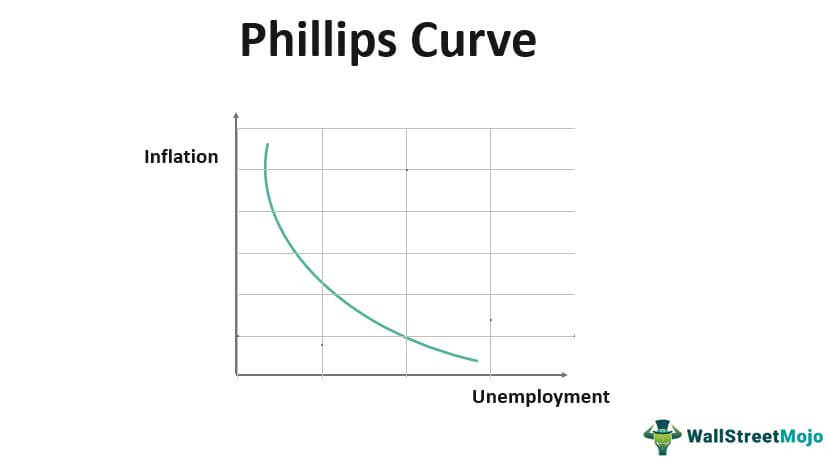

It is important to note that the relationship between interest rates, inflation, and unemployment is not always straightforward. While high inflation might lead to higher interest rates, remember that as the interest rates rise, unemployment follows.

The ‘Phillips Curve’ presents to us that when inflation is high in an economy, unemployment is comparably low, and when the inflation is low, inversely, unemployment is high.

Net Migration

Net migration impacts housing demand and rental prices. A decrease in migration naturally leads to less demand for rentals, and vice versa. Whilst migration is certainly great for the economy in a general sense, it doesn’t tend to have an effect on real estate prices. Migration does however have a profound effect on rental prices, as immigrants entering New Zealand are often seeking rental property, where they commonly aren’t in a position to purchase.

This point further proves my thought that immigration increases will make it attractive again for investors to return to the market and purchase rental properties. This appetite for rental properties will in turn negate the recent increases in rental prices that has resulted from the lack of rental property in New Zealand

Investors and the Rental Market

The attractiveness of the rental market in regard to investors depends on factors such as interest rates, potential capital gains, and tax policies. The government’s tax policies, like bringing back depreciation and tax benefits while removing capital gains tax, influence investor behaviour in the real estate market. Investor behaviour will also likely be altered as the interest rate decreases and house prices decrease, which I expect will occur towards the first and second quarters of 2024.

Solutions

To address the current housing market situation, policy makers, sooner rather than later, are going to have to consider adjusting interest rates, implementing policies that improve housing affordability, and incentivising investment in the real estate market.

It is worth noting that economic situations are often complex and multifaceted, and the interactions between various factors can lead to different outcomes. The future economic landscape will depend on how these factors evolve and how policy makers respond to current challenges.

Feel free to contact us at any time to enquire about current market trends, and keep an eye out for our future predictions. We are here to help and provide advice appropriate for your best interests. At Najib, we know what’s important.

Real Advice - We discuss the August market.

Real People - We do auctions totally different at Najib, take a look.

If we can assist with any of your real estate needs, please don’t hesitate to get in touch with a Najib agent.