October marked a positive change for New Zealand with Inflation rate being announced at 2.2% on 16th October by the RBNZ .

This article explores the recent inflation rate changes, the impact of OCR & mortgage cuts, New Zealand’s unemployment level and the government’s policies affecting the economy towards a positive change.

Table of Contents

NZ Inflation Drops: What It Means for the NZ Market

OCR & Mortgage Rates: How Does the Future Look?

Unemployment in NZ: Will It Improve?

Mortgage Approvals vs. Supply of Housing

The Real Estate Cycle: Understanding Where the Market is Heading

FAQ

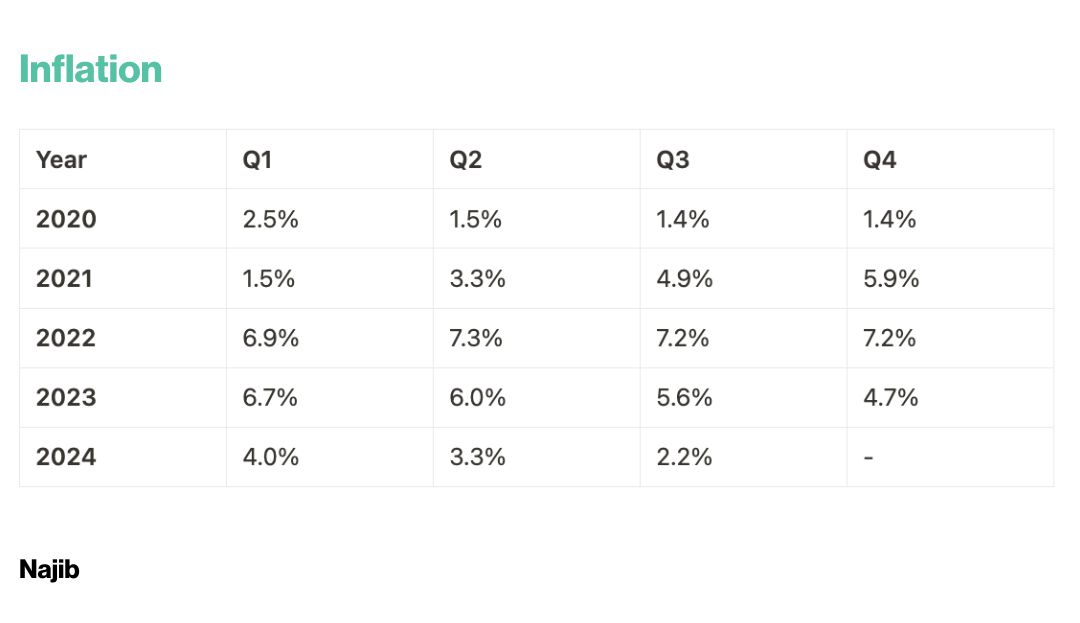

As of now, inflation in New Zealand has come down to 2.2%. This is a significant improvement from the 7.2% high seen in 2022.

Here’s a quick comparison data chart to give you an idea about the past inflation rate trends in New Zealand.

Inflation data usually shows changes after they’ve already happened in the economy. So, even though prices have stayed high for a while, the overall economy is now starting to settle down gradually.

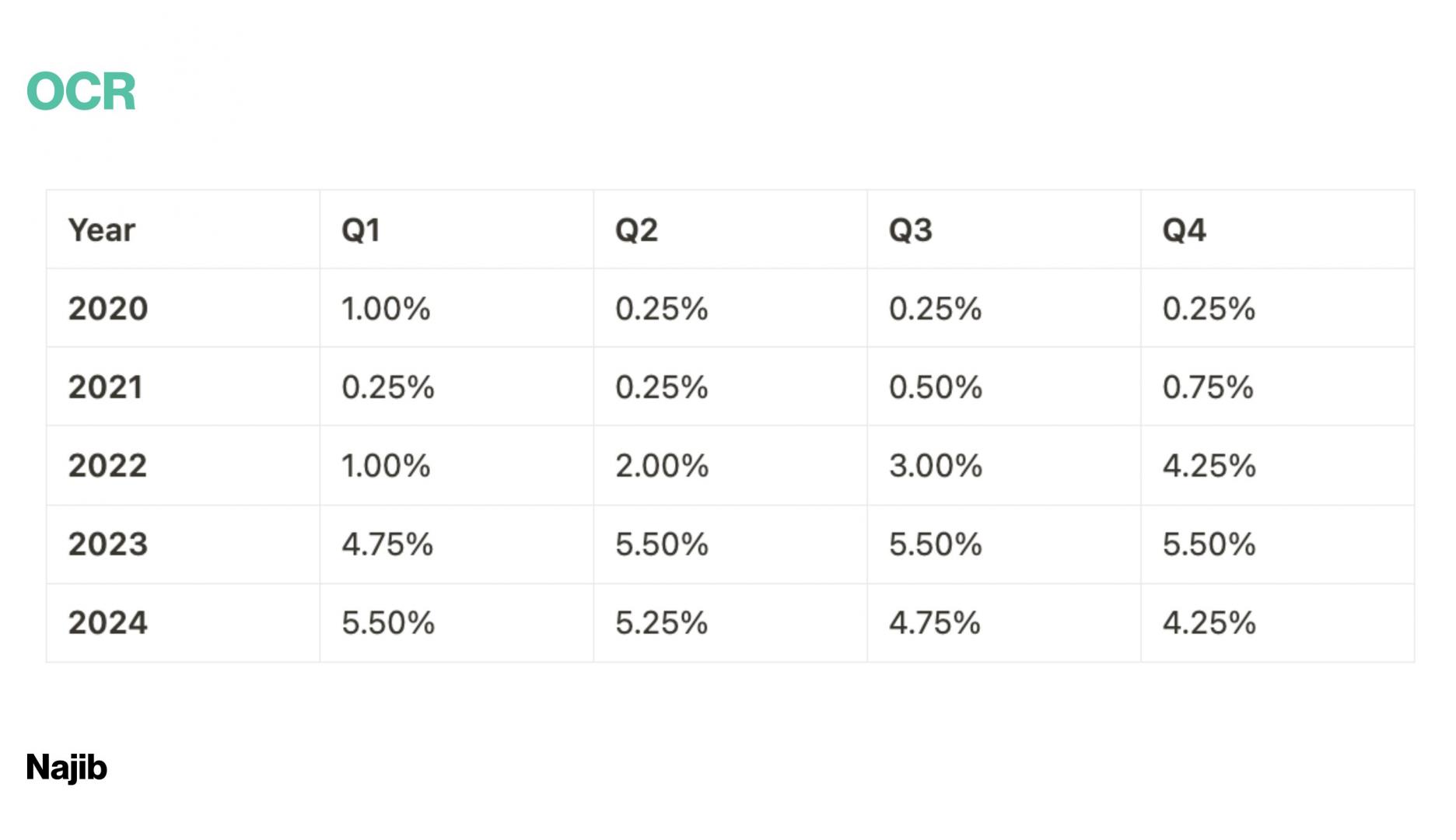

The Official Cash Rate (OCR) plays a crucial role in determining mortgage rates. When inflation was high, the OCR was purposely kept low to encourage spending, which led to increased property prices.

The Current OCR is set at 4.75%, and the next announcement is Tuesday, November 26, 2024 from 5–7 PM.

Here’s a quick comparison data chart to give you an idea about the past OCR trends in New Zealand

Note: 2020 Q2 saw a significant reduction due to COVID-19 impact. 2021 Q3 marked the start of rate hikes to counter inflation. 2024 Q4 is as of October.

The recent economic strategy of increasing the OCR to curb consumer spending is yielding results. With inflation now at a manageable level, these adjustments are gradually improving the economy.

We recommend watching our Christchurch House Price Prediction to help you understand better all the terms and trends for self forecasting.

The government's recent policy changes under the National Party aim to curb inflation, stabilise the economy, and prioritise effective use of taxpayer funds.

The key measures include implementation of Debt-to-Income (DTI) restrictions to ensure sustainable lending, while the removal of the First Home Grant will help reduce market distortions and unnecessary spending.

Earlier this year major infrastructure projects, like Auckland’s costly light rail and additional funding for KiwiRail’s portside infrastructure, were canceled to reallocate funds toward more immediate economic priorities. By scaling back on high-cost projects and tightening financial regulations, the government aims to bring the economy and housing market back to more affordable levels.

Watch the in-depth video How National NZ Policies Are Bringing Down House Prices NZ

As part of the government's efforts to curb inflation, businesses can't afford to keep operating at their previous levels. High costs for goods and higher rates lead businesses to cut spending, which often results in staff reductions. This is why we're seeing the unemployment rate increase to 4.6%, a noticeable rise from previous levels.

By reducing workforce costs, businesses can maintain financial health and mitigate risks during this uncertain economic period.

Unemployment Stats:

4,000 layoffs recently occurred in the New Zealand public sector alone, contributing to a total of 33,000 more unemployed individuals compared to last year.

131,200 departed New Zealand in 2024.

383 Auckland businesses went into liquidation 93 were property businesses.

This trend shows a direct correlation between inflation and employment levels, as the efforts to lower inflation leads to high unemployment rate.Like we always say it's important to understand about Phillips Curve which explains the correlation between inflation and unemployment.

Unemployment, as one of the five key economic variables, is unfortunately a byproduct of resetting the market, ultimately paving the way for recovery and sustainable growth.

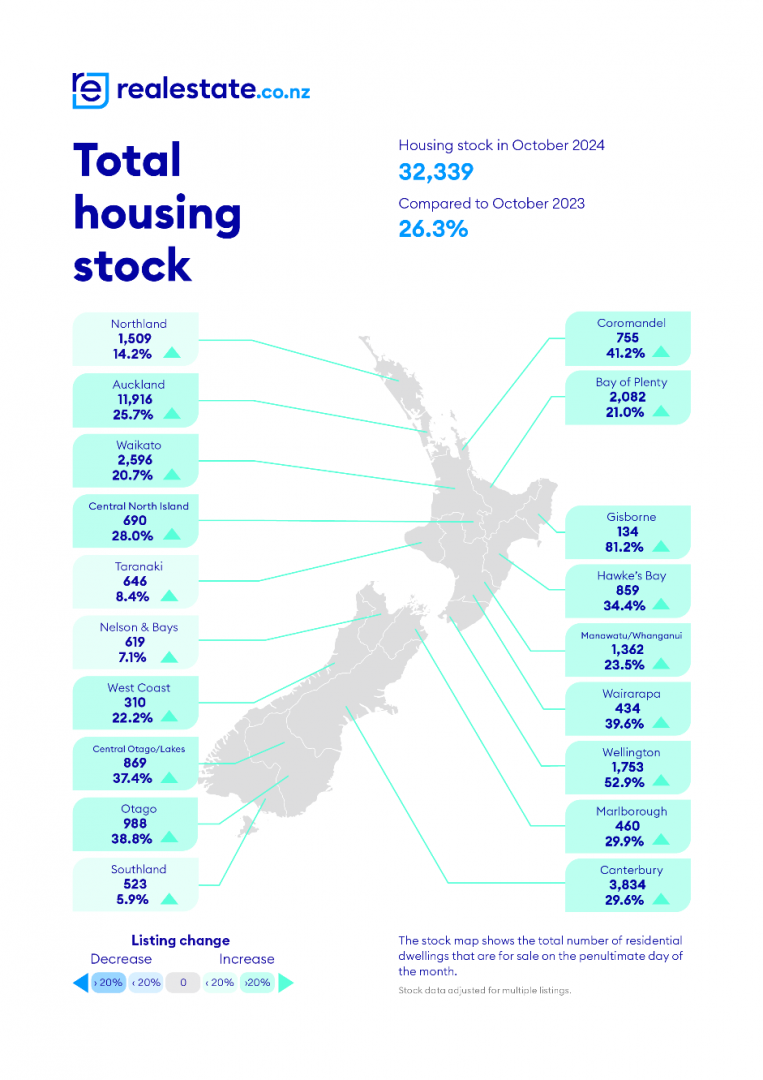

There has been a significant increase in housing supply over the past year, with a 20% rise in available properties.

This oversupply, combined with a decrease in mortgage approvals, has led to a decline in property prices. From January to September 2023, the supply of homes was 233,000, which has now increased to 28,258 in 2024 (212,742 increase) indicating a shift towards a buyer's market.

Highest October stock levels in a decade, up 26.3% year-on-year Real Estate NZ*

The real estate cycle is a critical aspect for investors, buyers, and sellers to consider. The current cycle reflects a market that is likely nearing its bottom. In the past, the market showed strong growth from 2019 until the pandemic hit, followed by a rapid increase due to monetary stimulus. However, as inflation rose and interest rates adjusted, the market began to cool.

Key variables affecting the property cycle include:

Interest Rates: Higher rates have cooled the market as borrowing costs increase.

Supply and Demand: An oversupply of homes has led to decreased prices.

Economic Conditions: Increased unemployment affects consumer confidence and spending.

Government Policies: Changes in regulations can impact market dynamics.

Investor Sentiment: Market confidence influences buying and selling decisions.

As we approach the end of 2024, at Najib we expect the house prices to drop further, providing opportunities for potential investors. However, we still predict the market to recalibrate, and it may take another 12-24 months before we see the market return to a healthy growth rate of 2-4%.

Finding honesty and transparency in the NZ Real Estate Market can be tough, with so many hidden agendas. That’s why we’re here. As active agents on the ground every day, buying and selling homes, we bring you the truth—plain and simple. This blog will guide you to make informed decisions for your real estate plan for 2025.

What is the current inflation rate in New Zealand?

The current inflation rate in New Zealand is 2.2% as of Q3 2024.

What is the unemployment rate in New Zealand?

The unemployment rate is currently at 4.6%, showing an increase compared to last year.

How does the OCR affect mortgage rates?

The OCR directly influences mortgage rates; when the OCR is lowered, borrowing becomes cheaper, and vice versa.

Is now a good time to invest in property?

While the market is nearing its bottom, potential investors should proceed with caution and consider purchasing when the interest rates are lower, and first home buyers are not as active.

If you require any free advice, contact Nathan Najib at hello@najibre.co.nz.