Table of Contents

Christchurch House Prices | The Insights You’ll Learn

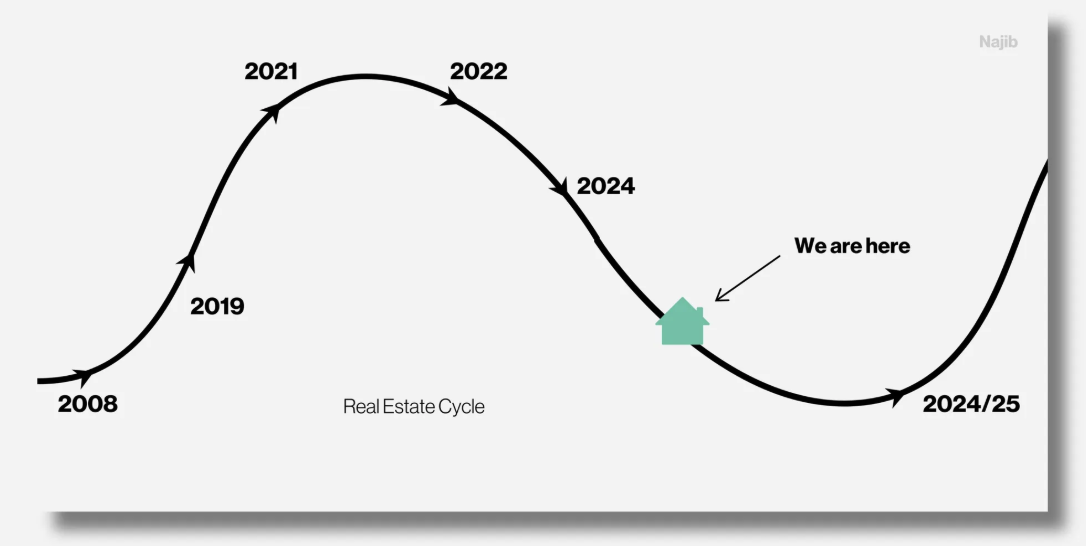

Understanding the real estate market cycle

Christchurch Real Estate Cycle | Where Are We

Historic Christchurch House Prices & Future Outlook

Median House Price Comparison | Christchurch Vs. Major NZ cities

Is Christchurch good for investors? | Property Investment NZ

Best Christchurch suburbs to invest

What can you buy for the median house price in Christchurch in 2024?

High rental yield suburbs in Christchurch

Thinking of living in Christchurch, New Zealand?

In this article we explore about the house price trends in New Zealand and Christchurch house prices for you to understand how the real estate market has been over the years, plus we also share our thoughts why we suggest Christchurch is an upcoming city in New Zealand for New Zealand first home buyers, sellers or investors.

Using our data and economic indicators below, you'll learn about the house prices in Christchurch and is it an ideal city for you to buy, build, sell or invest?

We have also stated what causes the dip and future trends for Christchurch house prices in 2025 and beyond.

Najib Disclaimer: Many sites or resources provide delayed reports on the housing market. Our goal is to offer you honest, transparent information in real-time.

We're actively on the ground every day and share our firsthand observations of the real estate market and Christchurch house prices.

If you are looking to buy or sell at the right time, it’s crucial to understand the real estate cycle.

By looking at the cycle you will understand the trends and predict where Christchurch house prices are heading in 2025 and beyond.

The Real Estate Cycle consists of four distinct seasons:

Expansion (Spring)

Peak (Summer)

Contraction (Autumn/fall)

Trough (Winter)

Each season presents unique opportunities and challenges for both buyers and sellers.

By recognising the signs of each season, you can make strategic decisions to maximise your real estate investments.

For a clear explanation on the Real Estate cycle, refer to our article here.

The real estate market operates in a cyclical pattern, moving through various seasons that impact Christchurch house prices and market dynamics.

Below we have identified where we believe the Christchurch property market is at.

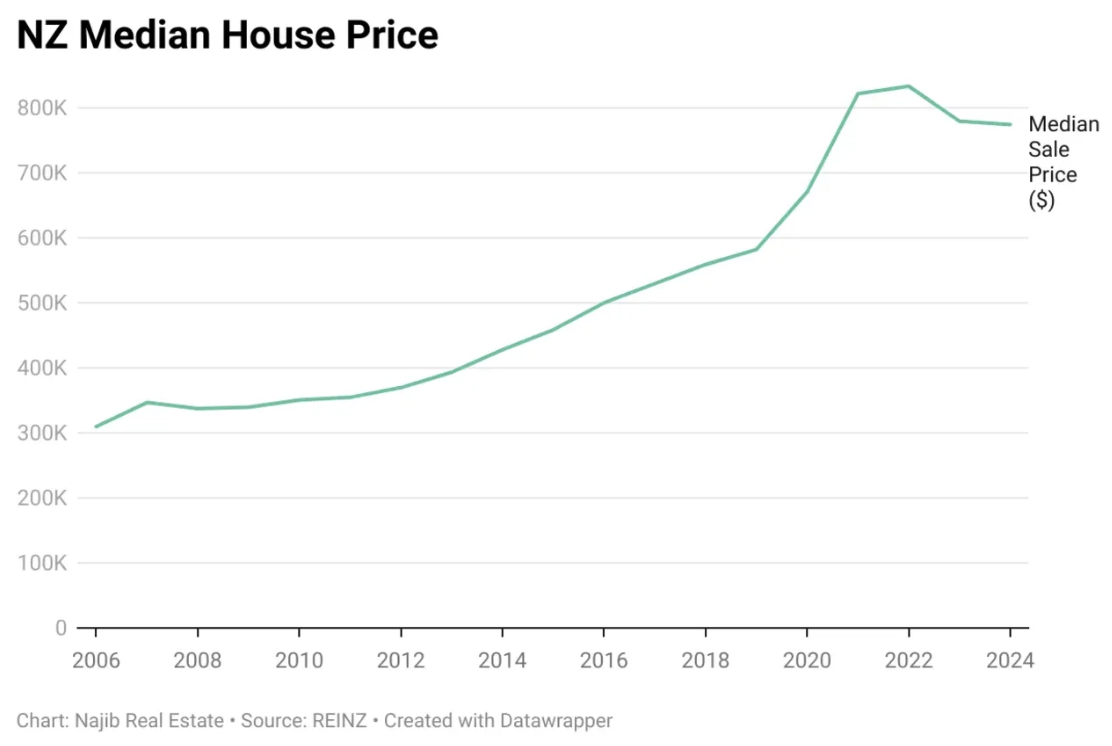

Since the housing market peaked in 2022 (Peak/Summer Season), the market has been moving towards the bottom, which we call the trough (winter). This has been a prolonged cycle due to unforseen events such as COVID.

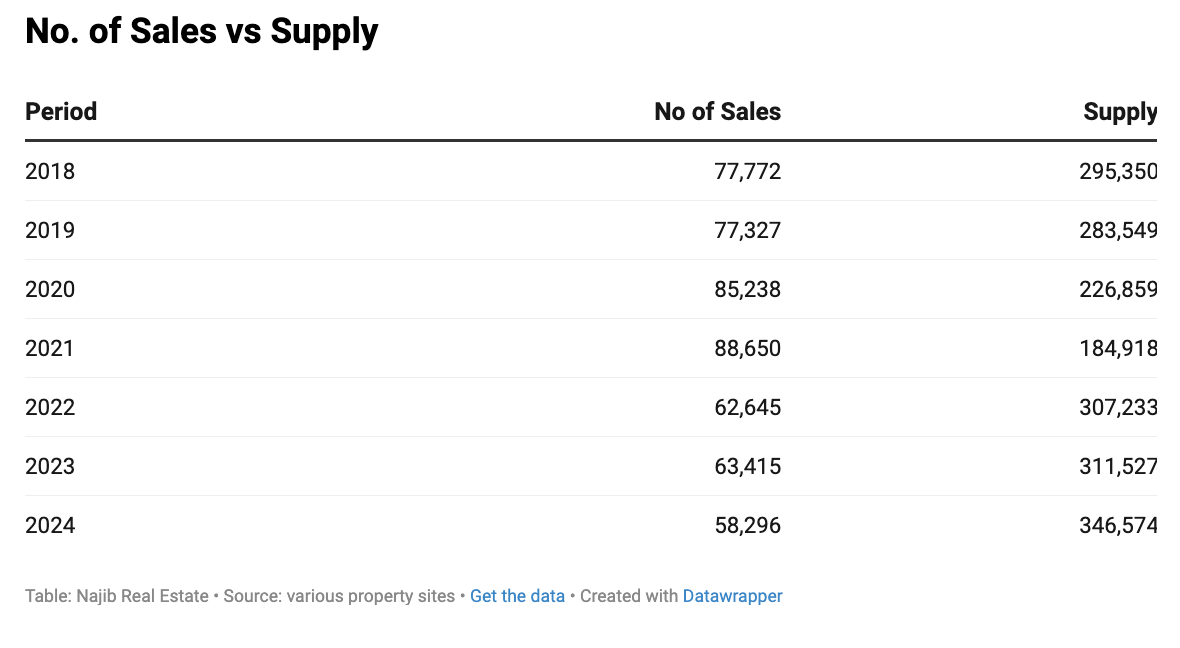

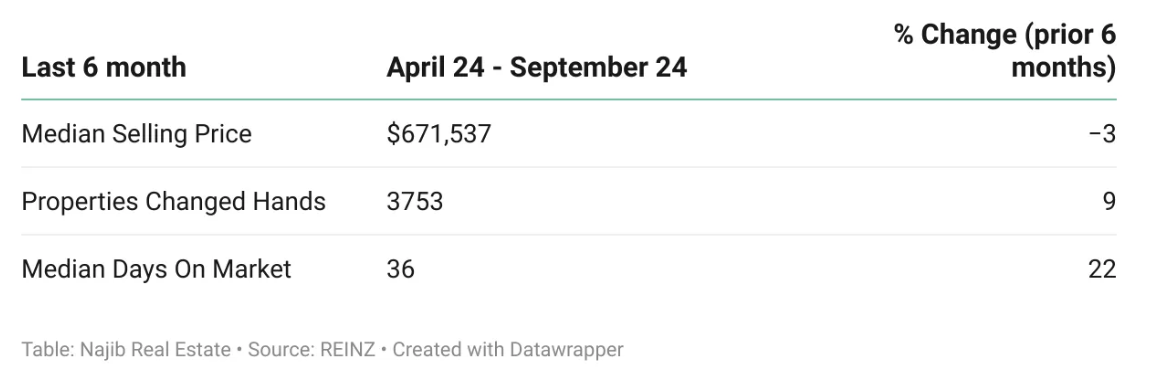

As of Q4 2024, we have now entered a buyer’s market. The supply of inventory vs demand is higher, which is a key factor in driving down house prices. Christchurch house prices are expected to decline further due to several economic factors, including higher OCR rates, persistent inflation, rising unemployment, and weakening demand. The data below shows how the housing supply has significantly increased since the pandemic in New Zealand, with more inventory likely to come onto the market in the near future.

Watch our Market Report video on why we suggest it’s starting to look like a buyers market.

The peak prices in the market are now unrealistic for many sellers. In 2024, homes are selling at or below their rateable values (RV), but there's no need for concern. During the peak, some homes were selling for 30% above their RV.

This shift in house prices is actually good news for Kiwi’s, as it makes housing more affordable and helps close the wide gap between wages and property prices.

This is based on agent’s knowledge and REINZ data.*

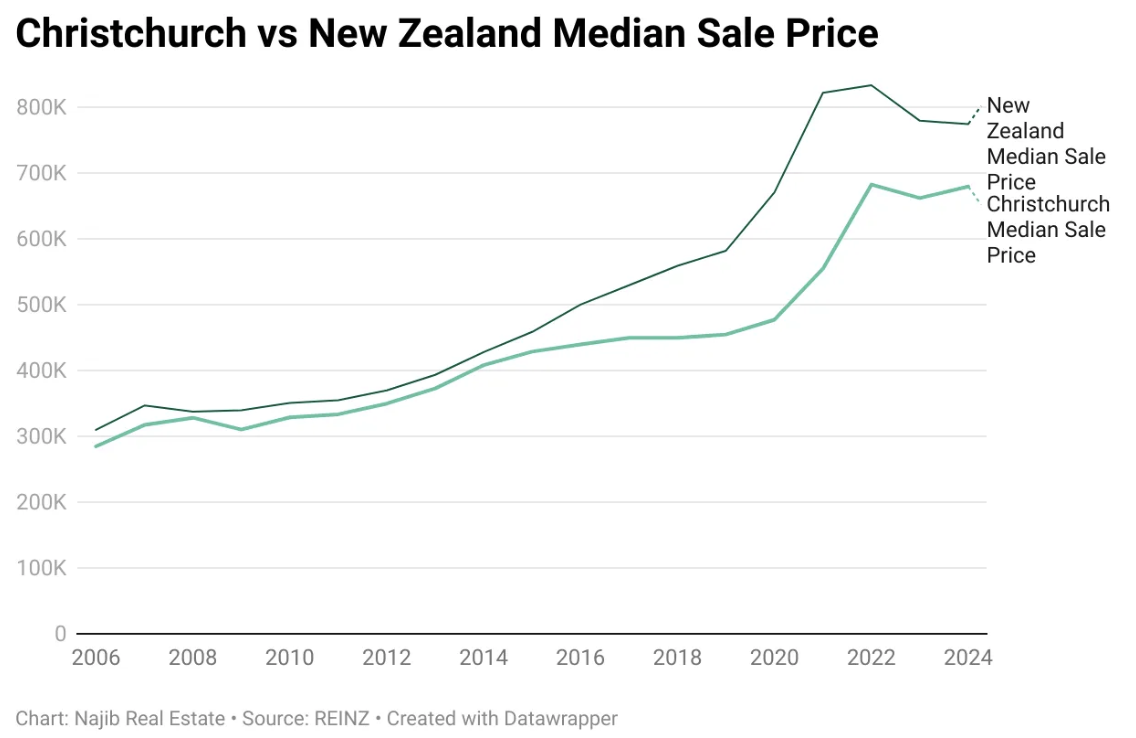

We've compiled historic Christchurch house prices to help you compare trends and understand the market.

Here is a list of annual data comparing from 2013 to 2023 for Christchurch House Prices

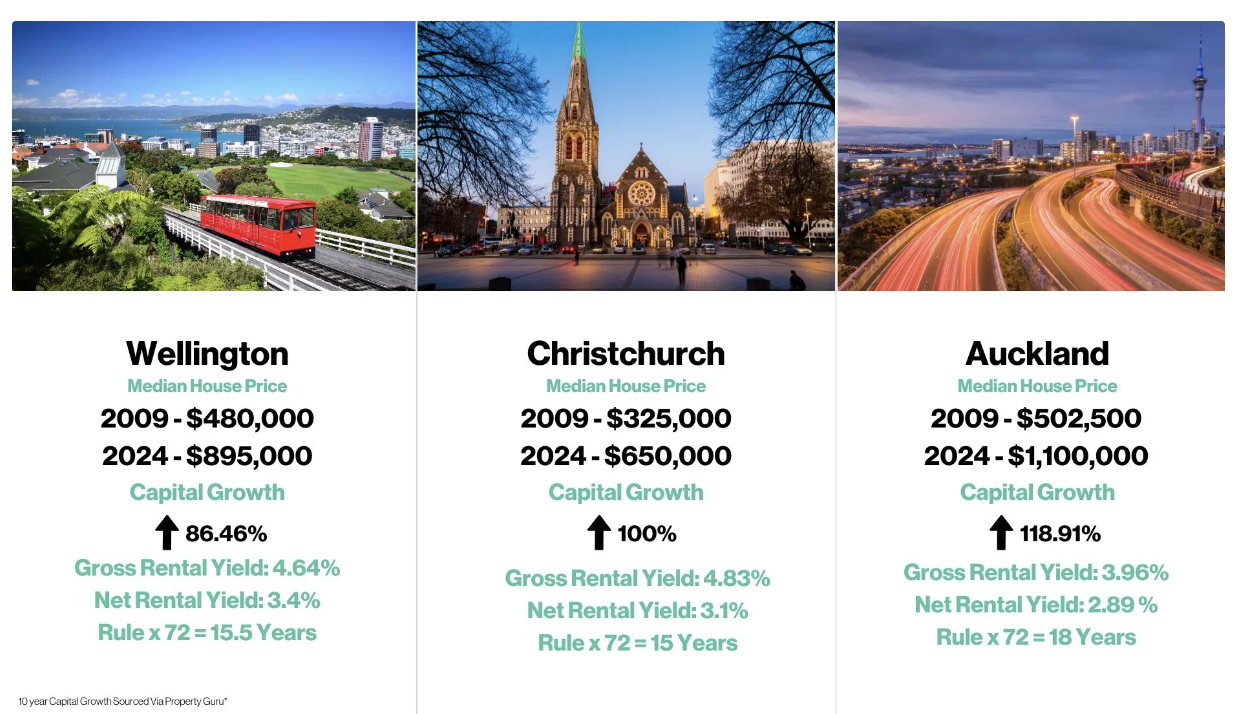

This is an example we did a Christchurch house price comparison 2009 vs 2024 (15 years/15.5 years) with two other major cities in New Zealand in September 2024. Watch the full comparison here.

2009 - $325,000

2024 - $650,000

Capital Growth: 100%

Gross Rental Yield: 4.83%

Net Rental Yield: 3.1%

Rule x 72 = 15 Years

(Septemebr 2024)

Christchurch house prices stands out as an attractive city for property investors, showcasing 100% capital growth in median house prices over the past 15 years (2009–2024).

This doubling in value highlights Christchurch's consistent and strong long-term appreciation, making it a high-performing market for capital gains.

On the rental side, the Christchurch house prices offer a gross rental yield of 4.83% and a net rental yield of 3.1%, which indicates a slightly better cash flow position compared to Wellington. While the net yield is moderate, it suggests Christchurch house prices can still provide reliable rental income alongside significant capital growth potential.

Using the "Rule of 72," property values in Christchurch are projected to double approximately every 15 years, aligning well with investor expectations for long-term wealth building.

Also to note in the coming years the city is expected to see more developments offering a compelling case for investors seeking a balanced mix of growth and rental returns.

2009 - $480,000

2024 - $895,000

Capital Growth: 86.46%

Gross Rental Yield: 4.64%

Net Rental Yield: 3.4%

Rule x 72 = 15.5 Years

Over the past 15 years (2009–2024), the median house price in Wellington has experienced a good capital growth of 86.46%, reflecting strong long-term appreciation. This indicates that Wellington has been a resilient and steadily growing market, appealing to investors seeking capital gains.

From a rental perspective, the gross rental yield of 4.64% and net rental yield of 3.4% suggest moderate cash flow potential. While these figures might not classify Wellington as a high-yielding market, they align with its profile as a balanced investment opportunity, offering a mix of growth and income.

At Najib we always suggest looking at The "Rule of 72", this calculation implies a doubling of property values approximately every 15.5 years, which further supports Wellington's viability for long-term wealth building.

Wellington appears to be a good option for property investors prioritising steady capital growth, supported by a reasonably healthy rental yield. However, prospective investors should weigh the market's affordability and rental demand to meet their investment goals.

2009 - $502,500

2024 - $1,100,000

Capital Growth 118.91%

Gross Rental Yield: 3.96%

Net Rental Yield: 2.89 %

Rule x 72 = 18 Years

Auckland, as New Zealand’s largest city, leads the pack in terms of capital growth with an impressive 118.91% increase in median house prices from 2009 to 2024.

This makes Auckland the strongest city in long-term appreciation compared to Wellington (86.46%) and Christchurch (100%). For investors focused on capital gains, Auckland is a clear standout.

However, Auckland falls short in rental yields, with a gross rental yield of 3.96% and a net yield of 2.89%, the lowest among the three cities. This reflects higher property prices relative to rental income, indicating Auckland is more of a capital-growth-oriented market rather than a strong cash flow investment. By contrast, Wellington and Christchurch house prices offer better rental returns, making them more balanced options for investors seeking both income and growth.

Using the "Rule of 72," Auckland's doubling time of 18 years is longer than Christchurch (15 years) and Wellington (15.5 years), reflecting its higher property values and slower relative pace of future capital growth.

Watch the in-depth video on the “Best NZ City To Invest”.

This in depth video will help you understand what you can buy for the median house price, and explains the rule of 72 in real estate.

Why Najib reports on median house price not average home price?

Unlike the average price, which can be skewed by very high or very low property values, the median offers a clearer picture of typical housing costs in the Christchurch property market.

Christchurch is a promising destination for property investors, offering affordable entry points compared to Auckland and Wellington, alongside high rental yields in key suburbs like Riccarton and Addington.

Here's a breakdown of Christchurch suburbs by price ranges to give investors an idea what you can get in different popular suburbs in Christchurch.

Checkout here

Clifton: $1.98 million

Scarborough: $1.84 million

Richmond Hill: $1.65 million

Kennedys Bush: $1.66 million

Strowan: $1.36 million

Fendalton: $1.28 million

Cashmere: $1.06 million

Ilam: $905,000

Northwood: $875,000

Halswell: $860,000

Beckenham: $810,000

Phillipstown: $489,000

Aranui: $500,000

Bromley: $520,000

Linwood: $522,000

New Brighton: $535,000

Christchurch Property Rates (Search RV for a Christchurch Suburb) Data courtesy REINZ, PropertyGuru*

We recommend that investors consider a few things before planning to invest and take a look at Christchurch house prices for ROI.

We recommend a few things to lookout for* when planning to invest in Christchurch.

If you are an investor and thinking to invest in Christchurch on rental properties, here are a few Christchurch suburbs we suggest for high rental yield.

Best suburbs to invest in Christchurch | Top Christchurch rental yield suburbs for 2025:

Apart from affordable Christchurch house prices, there are other things that make the city promising in the coming years. If you're considering moving to Christchurch, here's a look at the latest developments and quick facts about the city.

Who is it good for?

Christchurch city is perfect for those seeking a mix of urban and outdoor living, with a strong sense of community and numerous development projects. Many locals describe Christchurch as a town with city luxuries.

What's it like to live in Christchurch?

Living in Christchurch means enjoying a city that's both modern and close to nature, with new urban developments, state-of-the-art facilities, and a growing tech scene. It's a city for families and professionals.

Population: Christchurch is the largest city in the South Island, with a population of 396,200 as of June 2023, and it's expected to grow to 448,000 by 2048.

Innovation Hub: Known as New Zealand’s "Silicon Valley," Christchurch is a leader in tech innovation, home to 7,740 people employed in hi-tech services and fostering a growing startup culture.

Green Spaces: Christchurch is known as the "Garden City" for a reason—there are over 740 parks in the city, including the expansive Hagley Park, which is larger than New York’s Central Park.

Post-Earthquake Resilience: Following the 2010/2011 earthquakes, Christchurch underwent a significant rebuild, embracing modern design and earthquake-resilient infrastructure, making it one of the most resilient cities in the world.

New Developments: Christchurch continues to evolve with major projects like the Te Kaha multi-use arena and the Parakiore Recreation Centre, positioning it as a city with world-class sporting and recreational facilities.

Key Urban Developments:

ChristchurchNZ is leading urban development projects aimed at stimulating sustainable economic growth and enhancing community well-being. These projects include newly built homes close to community centres, shops, and beaches, promoting a balanced lifestyle.

New Stadium – Te Kaha

A state-of-the-art, multi-use arena is underway in Christchurch. With a budget of $683 million, Te Kaha will seat 30,000 for sports events and accommodate 36,000 spectators for large music events.

Parakiore Recreation and Sport Centre

Christchurch will soon be home to New Zealand’s largest aquatic and indoor recreation facility. The Parakiore Centre will cater to all ages and abilities, further enhancing the city's appeal for families and sports enthusiasts.

Growing Tech-Hub

Christchurch is a thriving hub for tech innovation, home to some of New Zealand’s most successful entrepreneurs.

All these upcoming project ca play a huge factor in changing the Christchurch house prices in the coming future.

Thinking to sell your Christchurch property? Begin with a property valuation today.

A property valuation/appraisal is simply an agent’s professional advice on what your property is worth. Completing a property appraisal on your home is part of the sales process and happens before a home is listed with any agent.

Here’s why many Cantabrian’s choose to sell with Najib.

Data courtesy:

Christchurch City Council: Canterbury Arena

ChristchurchNZ: Tech Sector

Christchurch City Council: Population and Demographics

Christchurch house prices still showing a slow drop due to various economic factors ever

The best time to buy depends on your personal financial situation and the market cycle. With Christchurch house prices offering relative affordability, now might be a good time to explore opportunities, especially if prices are stabilising

Affordability: Lower property prices compared to Auckland and Wellington.

High Rental Yields: Suburbs like Riccarton, Addington, and Linwood offer strong rental returns.

Population Growth: Steady demand due to growth in suburbs like Rolleston and Lincoln.

Modernised Infrastructure: Post-earthquake developments attract buyers and renters.

Diverse Economy: Strong job market in technology, agriculture, and manufacturing.

Looking at current economic factors of New Zealand including the OCR and inflation rate, we predict Christchurch house prices could to still drop steadily.

Watch our latest video

The median house price in Christchurch is $650,000 NZD as of 2024, with homes typically selling close to their Rateable Value (RV). Comparatively:

Wellington: $895,000 NZD (RV: $1,130,000)

Auckland: $1,100,000 NZD (RV: $1,220,000)Christchurch offers greater affordability, making it a popular choice for first-home buyers and investors.

Living in Christchurch offers a balance of urban convenience and outdoor lifestyle. Key highlights:

Population: 396,200 (2023), projected to grow to 448,000 by 2048.

Green Spaces: Over 740 parks, including Hagley Park, larger than New York’s Central Park.

Post-Earthquake Resilience: Modern infrastructure with earthquake-resilient designs.

Innovation Hub: A growing tech scene, earning the title of New Zealand’s "Silicon Valley."

What is the richest suburb of Christchurch?

Clifton: $1.98 million

Scarborough: $1.84 million

Richmond Hill: $1.65 million

Kennedys Bush: $1.66 million

Strowan: $1.36 million

Fendalton: $1.28 million

The median house price represents the middle value of all house prices in a given area during a specific time-period. It means that half of the homes sold were priced above this figure, and half were priced below it. Current median Christchurch house price is $650-670,000* (Data courtesy PropertyGuru).

Other resources

When is the next inflation announcement nz ?

January 22nd 2025

When is the next nz ocr announcement?

19th Feb 2025

Outer growth areas: Rolleston ($725,000), Lincoln ($780,000), and Prebbleton ($850,000) offer excellent long-term investment potential.

Checkout our market reports in Lincoln and Rolleston

All research is done by Najib Team and agent experience.