Table of Contents

What is a Gross Domestic Product (GDP)?

The Impact on NZ Property Market | How recession affects the economy?

Tips on Navigating the Recession | Recession Who Benefits?

A recession is a period of significant economic decline, typically marked by a decrease in GDP (Gross Domestic Product) for two consecutive quarters or six consecutive months. It is a natural part of the business cycle and often follows a period of economic growth.

Gross Domestic Product (GDP) is a measure of the total value of all goods and services produced within a country's borders over a specific period. It serves as an indicator of a country's economic performance and overall wealth.

In the case of New Zealand, we have been predicting this downturn for quite some time now. The property market has experienced an unprecedented surge, with house prices skyrocketing by 54%. Such rapid growth is unsustainable and inevitably leads to a correction.

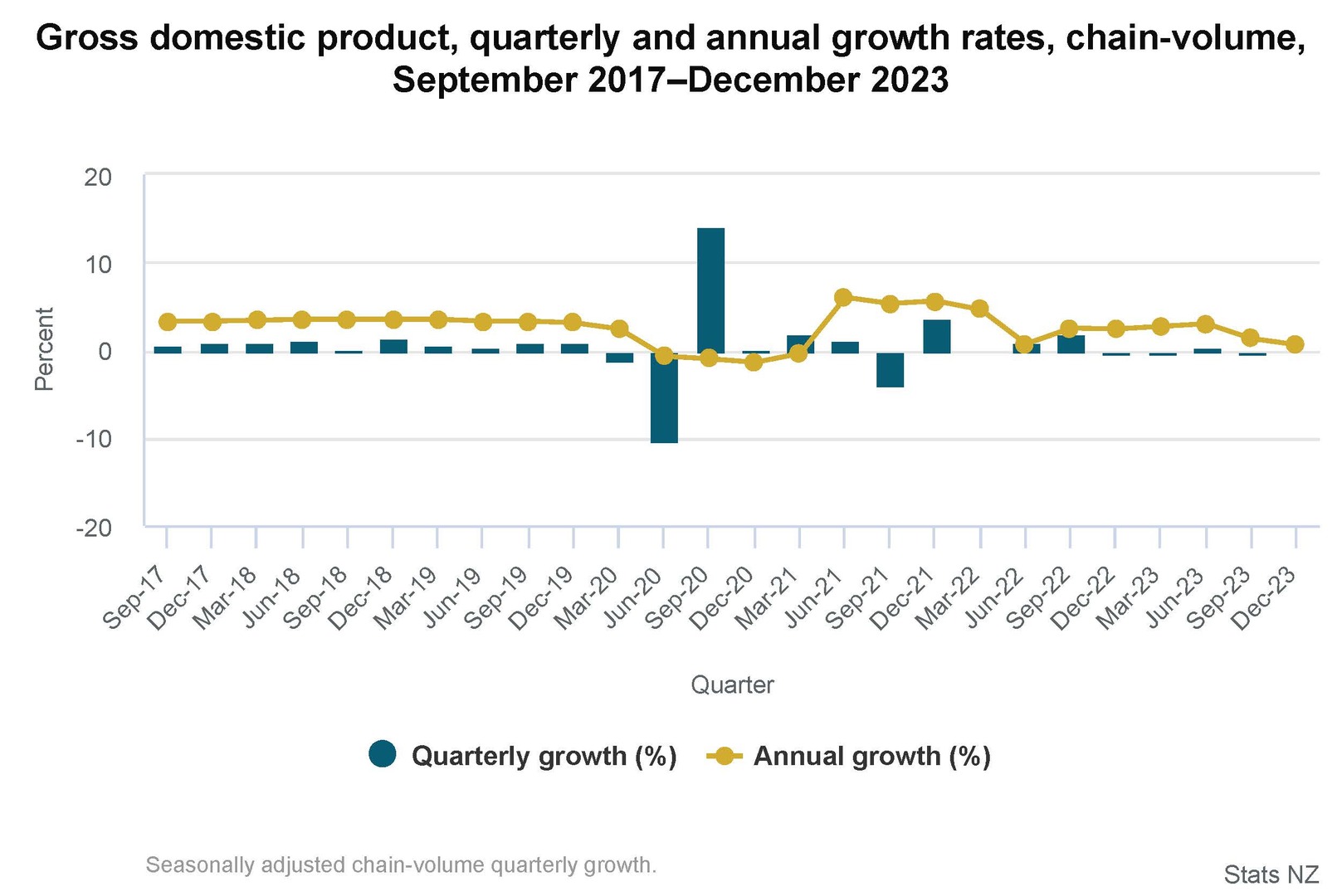

Courtesy by Stats NZ

Back in 2017, New Zealand's economy was cruising along with an annual GDP growth rate of about 3.3%. But then the pandemic hit, and by 2020, things took a nosedive, with GDP growth dropping to around -1%. It was a tough time for everyone.

However, by June 2021, the economy started to bounce back. We saw a surge, with GDP annual growth shooting up to 6%.

But you know how it goes with the business cycle – what goes up must come down. Signs of a downturn began to show, and by December 2023, annual GDP growth has slowed to just 0.6%. Signs of recession.

In New Zealand we are now experiencing the second recession in 18 months. As mentioned in this article Winter Is On It’s Way we indicate the signs to look for when a recession/ decline is looming. A typical recession is linked to the following factors:

Weak consumer spending - lack of affordability puts financial strain on households and can have long-term consequences for the overall economy

Unemployment - Rising unemployment pushes consumer spending down even further, setting off a vicious cycle of economic contraction.

Excess unsold housing stock - This is a situation of excess supply but less demand. Due to inflation and unaffordability, there are fewer buyers and developers are left with unsold stock.

Slow housing market - The property market is often negatively affected by recessions. Home prices may decline, leading to reduced household wealth, and construction activity may slow down as demand for new homes decreases.

If you would like to understand how we measure our predictions, read the Five variables in real estate market

With the market reaching such high pricing levels, it was only a matter of time before a decline occurred. We have already witnessed a 10% decline when we were at the peak, and it is likely that further downturn is still to come.

In order to understand the impact, it's important to consider what constitutes a healthy growth in real estate.

A healthy growth rate is typically between 2% to 4%. This ensures that property prices remain affordable for buyers, as they are in line with salary increases. However, when property prices outstrip salary growth, as we have seen in recent years, it becomes increasingly difficult for people to afford homes.

To rectify this imbalance, property prices need to come down by around 15-20%. While this may seem alarming, it is necessary to restore affordability in the property market. The current decline is a necessary correction that will bring the market back to a healthier level.

Read the in-depth blog on Seasons of Real Estate

Now that we find ourselves amidst a recession, it's important to navigate these challenging times wisely. Ideally, preparations should have been made during the peak of the market. However, if you find yourself unprepared, there are still steps you can take to navigate the recession.

It's important to remember that the current recession will not turn around overnight. It will take time, likely another 6 to 12 months, for the market to reach its bottom and stabilise. Once that happens, we can expect a slow recovery and a return to a healthy growth rate of 2% to 4%.

To conclude, the recent announcement of a recession in New Zealand has significant implications for the property market. However, the decline we are witnessing is a necessary correction to restore affordability to the market.

While the road to recovery may be long, it is important to stay informed and make decisions based on your individual circumstances.

If you have any questions related to the property market in Christchurch or thinking of selling your home, feel free to write to us at hello@najibre.co.nz. Alternatively, you can follow us on our Youtube Channel where we release the latest property market updates in New Zealand.

Q: Can I wait for the prices to come back up before buying a property?

A: While it is tempting to wait for prices to rebound before entering the market, it's important to understand that a decline of 10-15% is expected. Once the market reaches its bottom, it will take several years for a recovery to occur. It is advisable to consider affordability and personal circumstances before making any decisions.

Q: When is the best time to buy real estate in Christchurch or New Zealand?

A: The best time to buy real estate is when the market is at its slowest, indicating a potential recovery in the near future. This allows investors to capitalise on future growth and maximise their long-term investment goals.

Q: Should I trust media sites and mortgage brokers when it comes to economic predictions?

A: It is essential to approach economic predictions with caution. Media sites and mortgage brokers often have their own interests and agendas. They may provide information that aligns with their goals rather than offering unbiased advice. It's important to seek information from multiple sources and consider the credibility and track record of those providing the predictions.