Table of Contents

Introduction

Real Estate market is cyclical

The Four Seasons of Real Estate

How to buy at the “right time” in Christchurch

Predictions and Facts: Understanding the Bubble

The Five Variables for Predicting the Future of Real Estate

Trough is on Its Way (How to Capitalise on It)

Conclusion

Welcome to today's article where I share the blueprint behind my successful predictions in the New Zealand and Christchurch real estate market. I'll guide you through practical strategies, revealing where the market is heading and pinpointing opportune moments for both buying and selling.

By the end of this read, you'll grasp the real estate market cycle, understand the five variables crucial for informed decisions, and gain insights into anticipated 2024 property trends.

Our mission is to empower you with transparent knowledge, ensuring you achieve the optimal return on investment when navigating the real estate landscape.

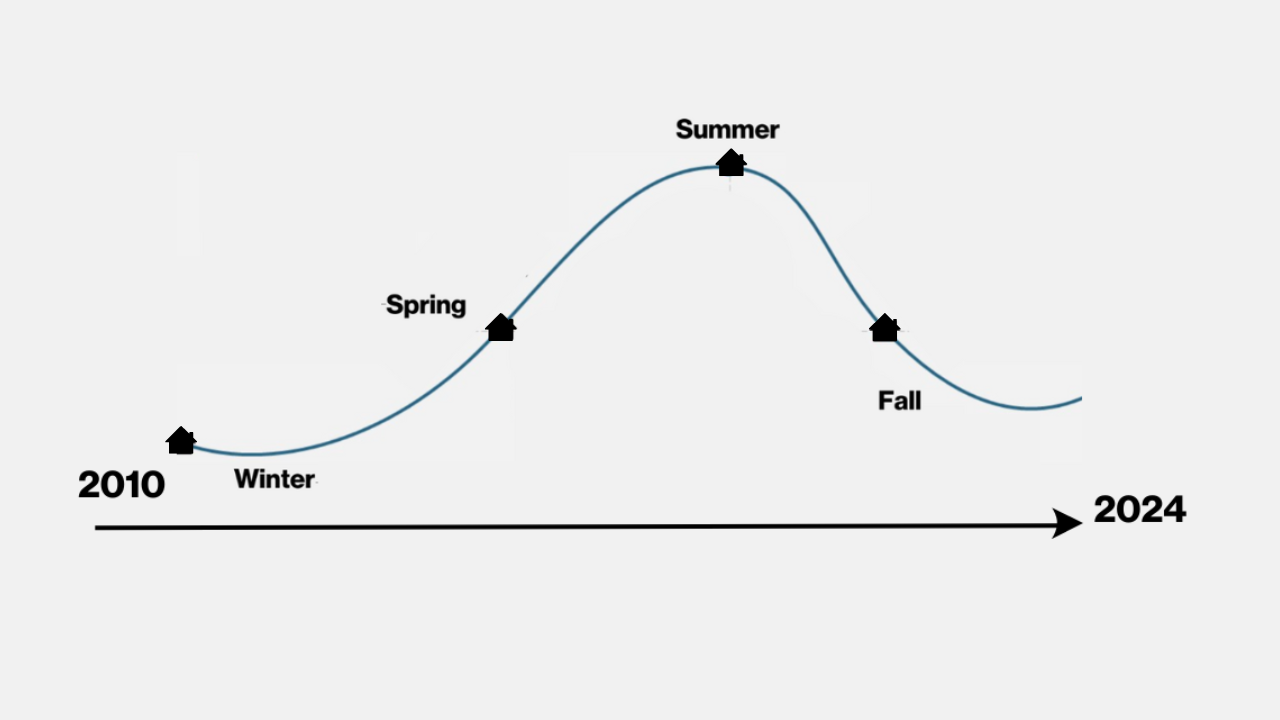

The real estate market operates in a cyclical pattern, moving through various seasons that impact property values and market dynamics. Understanding this cycle can help you identify the best times to buy or sell in real estate.

Cyclical means it has a repeated behaviour and cannot be skipped.

The Real Estate Cycle consists of four distinct seasons: expansion (Spring), peak (Summer) contraction (Autumn/fall), and trough (Winter). Each season presents unique opportunities and challenges for both buyers and sellers. By recognising the signs of each season, you can make strategic decisions to maximise your real estate investments.

Expansion (Spring):

During the expansion phase, also known as spring, everything is growing, and there are capital gains in property. This is a time of opportunity for buyers and sellers to make the most of increased property values and market activity.

Peak (Summer):

The peak season, or summer, is when the real estate market reaches its hottest point. This is the time when property values are at their highest, and sellers can make substantial profits. It's also a time when buyers need to be cautious to avoid overpaying for property. This was seen in the market peak in 2021 and 2022, the demand was high, coupled with low-interest rates resulting in many people paying above the rateable value for homes.

Contraction (Autumn/Fall):

As the market moves into contraction or fall, property prices start to decrease, and the number of listings begins to rise. Buyers have more options, and sellers need to adjust their expectations to align with the changing market conditions.

Our opinion is that we are currently experiencing this phase in the New Zealand/Christchurch Real Estate Market.

Trough (Winter):

Winter in real estate marks the lowest point in the market cycle. Property prices are at their lowest, and buyers can find great deals.

This is a time for strategic buying, as the market begins to recalibrate for future growth. As 2024 progresses we see the market entering this phase, with property supply high and demand low it will be a great time to purchase as the market returns to a normal, healthy growth of 2-4%.

The goal of investing in real estate is to build capital as soon as possible. Timing the market correctly can help investors achieve their financial goals at a faster rate.

Things I suggest to keep a note of are:

Understanding Cycle Length:

Real estate market cycles can vary in length, ranging from 2 to 4 years to 8 to 10 years. Recognising the length of the current cycle can help you make informed decisions about when to enter or exit the market.

Currently, the New Zealand and Christchurch property market in general is experiencing an extended cycle since the pandemic when the interest rates dropped and the peak saw a rise in demand. It’s been approximately 14 years since the last winter, and we are overdue for a correction.

Avoiding the Peak:

Buying property at the peak of the market can lead to potential financial losses unless you plan to hold the property long-term.

The peak always looks tempting, as many people experience the fear of missing out. It’s important to remember the peak is only temporary and it’s always best to sit off the market during the peak.

Christchurch Properties today are not worth what they were in 2021 & 2022.

A great example of this is when I sold a property in West Melton in 2021 for $2.175m. I am currently selling a similar property in 2024 for $1.7m. That’s a 22% decrease.

This is the power of selling in the peak, and potentially renting for some time before the market rebounds.

Making Educated Decisions:

By listening to the right people, studying past predictions, and conducting thorough research, investors can make educated decisions about when to buy and sell in the real estate market. In the past, we have seen 7 major market declines and we are seeing the same signs today.

Here are five signs we see during a bubble

I focus on five key variables that are crucial to predicting the real estate market:

Increase in Average Sale Price:

It's important to compare last year’s average sales price vs the current sales price.

Healthy growth in the average sale price is between 2 to 4% which indicates affordability. Any significant increase beyond this range can indicate an unsustainable market. If anything is beyond 4% then it is unhealthy. During the peak, we experienced sale price increase of over 20% year on year.

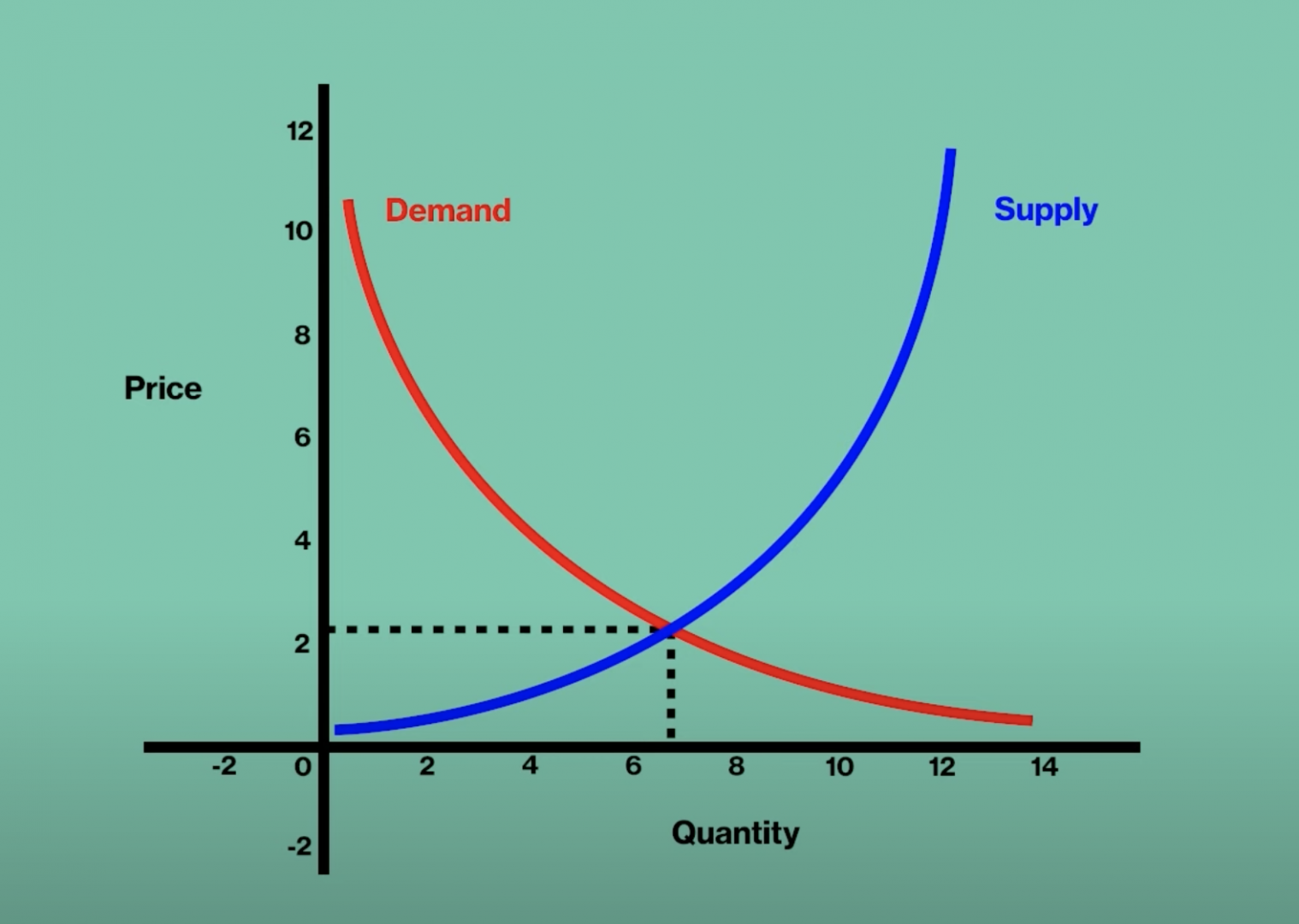

Inventory Levels:

Monitoring the number of properties coming onto the market compared to the number of properties sold can provide insights into the inventory levels of houses and future trends. Currently, in Christchurch, there is a huge stock of unsold inventory.

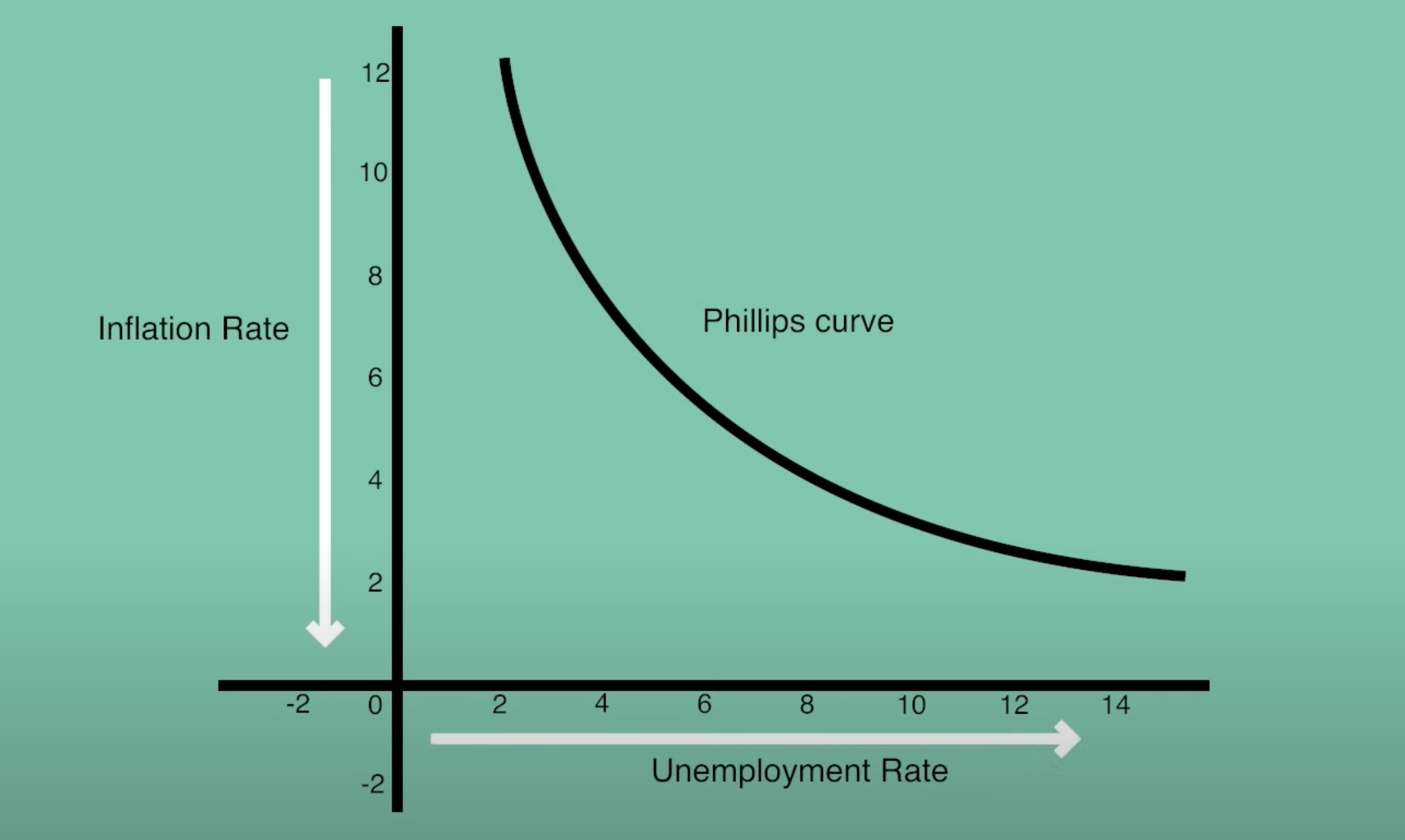

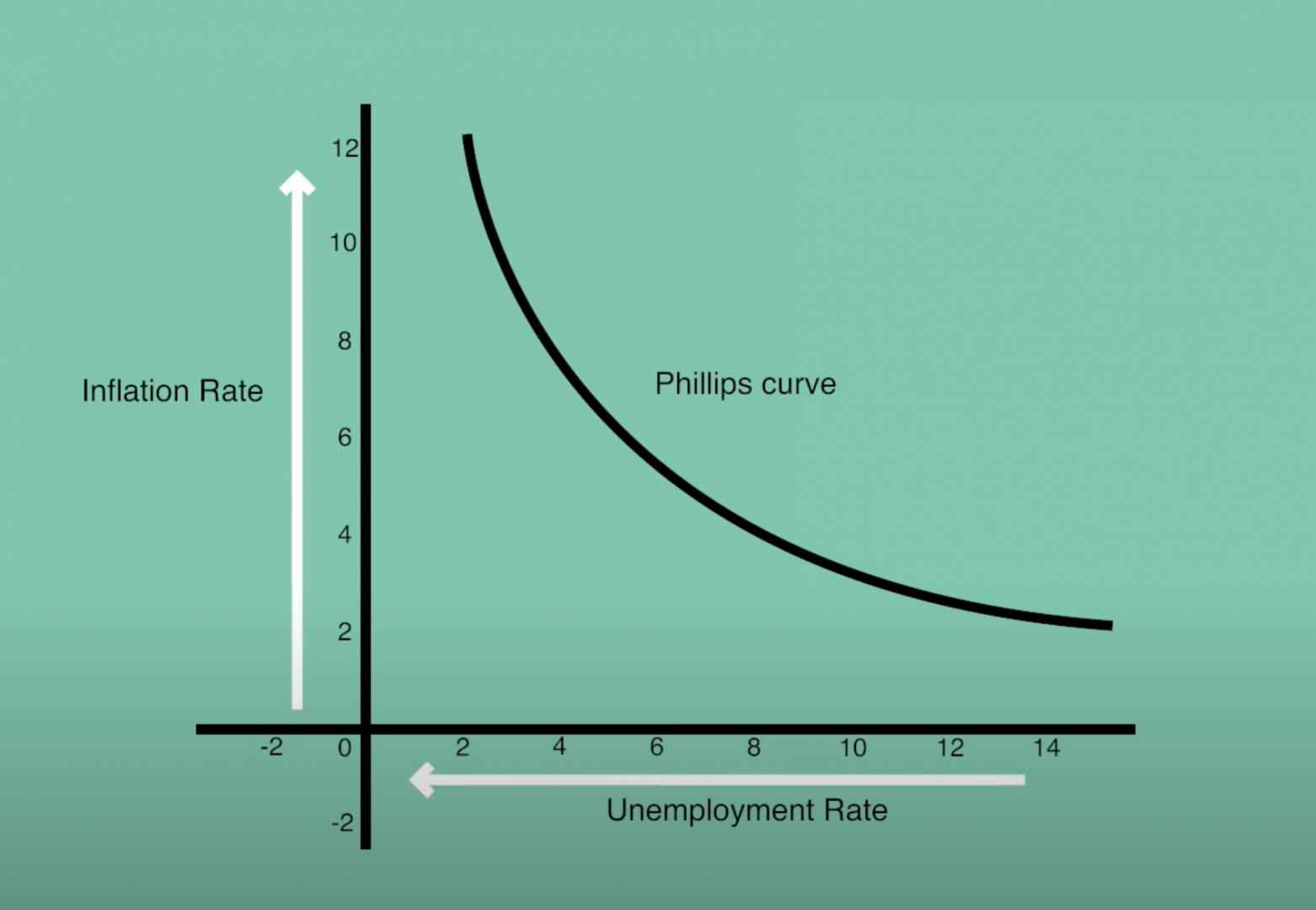

Interest Rate Fluctuation:

Fluctuations in mortgage rates can impact buyer affordability and market activity. Understanding these changes is crucial for predicting the future of real estate. If interest rates are low it is important to remember they won't stay low forever and when the economy inflates, The Reserve bank always brings the interest rates up to bring inflation down.

Impacts of Mortgage Rates - Past Vs Present Example:

Affordability and Inflation:

Monitoring inflation and unemployment rates can provide valuable insights into the affordability of real estate and overall market health. Under 2% inflation is healthy but anything higher is bad for an economy. Last quarter in New Zealand the inflation rate was at 4.6%.

Competition within Businesses (Phillips Curve)

Observing competition within businesses, such as banks offering discounts and developers dropping prices, can indicate the state of the economy and future market trends.

Lastly here’s why I suggest The Trough is on Its Way (How to Capitalise on It)

What season are we currently experiencing? In my view, supported by studies of the past seven market declines, all indicators suggest that we are nearing the trough, which is typically the lowest point in the market cycle.

We hope this article will equip you with analysing and understanding the real estate market. As mentioned, I suggest that the market is on the verge of a downturn, making it an opportune time to start considering buying and if you are looking to sell in the next few years, now is a great time before the market drops further.

If you still have any questions feel free to reach out to us, all our details can be found on our team page here: https://www.najibrealestate.co.nz/About-Us/Our-Team/.

Stay tuned for our next article and video on “How to buy your first investment property in Christchurch”. All articles include an in-depth video, which can be found on our YouTube channel here: https://www.youtube.com/@najibrealestate929

Important Resources

If you are thinking of buying or selling in Christchurch, I recommend reading the articles below to help you understand the market.

DTI Restrictions

2024 NZ House Prices

Selling your home

Why not to invest in a Townhouse

1. How accurate are real estate predictions?

Real estate predictions are based on historical data, market trends, and economic factors. While they are not guaranteed, accurate predictions are possible when made by experienced professionals who thoroughly study the market.

2. When is the best time to buy real estate in Christchurch or New Zealand?

The best time to buy real estate is when the market is at its slowest, indicating a potential recovery in the near future. This allows investors to capitalise on future growth and maximise their long-term investment goals.

3. How can buyers and sellers benefit from understanding the real estate market cycle?

Understanding the real estate market cycle empowers buyers and sellers to make informed decisions about when to enter or exit the market. By recognising the signs of each season, individuals can strategically navigate the market to capitalise on opportunities and avoid potential financial pitfalls.

4. What factors influence the length of the real estate cycle?

The length of the real estate cycle is influenced by various factors such as economic conditions, government intervention, market confidence, property inventory, and development releases. These elements play a crucial role in shaping the health of the real estate market and impacting the timing of market peaks and troughs.

5. How can investors predict the future of real estate?

Investors can predict the future of real estate by focusing on key variables such as the increase in average sale price, inventory levels, interest rate fluctuation, affordability and inflation, and competition within businesses. By understanding and monitoring these variables, investors can make informed decisions about when to buy and sell property.