Table of Contents

Guide to Property Investment NZ

Things to Avoid when buying an Invest Property

Best Suburbs to Invest in Christchurch 2024

In this educational article I will discuss the fundamentals of property investing in New Zealand. It will also provide easy tips to help you make wise investment choices when considering to buy an investment property in Christchurch in 2024 or beyond.

An investment property is a real estate property purchased with the intention of generating income or profit. It’s not meant for personal use, unlike a primary residence. Instead, it is used to generate rental income or to make capital gains through appreciation.

When purchasing your first investment property, it is important to have a long-term plan in mind. Always remember your first investment is not a home you will live in forever. Keeping that in mind and being practical will help you decide on a good house with at least three-bedrooms or a larger home that can accommodate tenants.

Be open to houses with sleep-outs, as this can provide extra income on top of the home you are renting out.

This will allow you to generate rental income and cover your mortgage expenses. By renting out the additional rooms, you can save money while benefiting from the capital growth of the property.

When investing in a house, it is crucial to prioritize capital gain. While rental yield is important for covering your mortgage expenses, achieving a positive rental yield can be challenging, especially when interest rates are high.

Instead, focus on making capital gains as quickly as possible. Even if you have to top up your mortgage for a few years, the goal is to benefit from the appreciation of the property over time.

Hence I suggest to always avoid buying in the peak.

Read an in-depth guide to the seasons of real estate to predict when to buy.

The wealthiest people have made their money by holding onto their properties long-term. Instead of selling their assets, they have benefited from the appreciation of their properties over time. Consider keeping your investment properties for the long haul to maximise your wealth-building potential.

Christchurch is a great city when it comes to investing or buying a more affordable house compared to other new zealand cities such as Auckland or Wellington .

Another great way to get a good return on investment is by making a few renovations to add value to the property, especially if you are a builder or handyman..

One common mistake to avoid when purchasing an investment property is buying during a peak market. Buying at the peak can result in higher prices and limited potential for capital gain. Instead, consider buying during a trough or when the market is experiencing a downturn. This will allow you to purchase properties at a more favourable price and increase your chances of making significant capital gains.

First home should not be your dream home. With the aim to get the maximum capital gain

you should avoid buying with emotional and sentimental attachment. Once you get good capital gain then you can use that money in buying a house for the future.

Make multiple offers, view many houses, ask questions to your local expert real estate agent and then make a purchase.

One of the main drawbacks of buying a townhouse is the limited potential for capital growth. Townhouses are often part of a larger development, which means that their value may be influenced by the overall market performance and the actions of other homeowners in the development. This can impact the rate at which the property appreciates in value.

Townhouse might be attractive but it won’t give you a good appreciation over the years and definitely not a good investment for a first home buy.

In my recent videos I have talked about house price prediction nz and when is a good time to buy. Watch here

Despite its growing popularity and development, Christchurch remains an affordable city in New Zealand, particularly for those seeking investment opportunities.

With its steady rise as a desirable urban center, the city offers promising prospects for property investors, especially in certain upcoming suburbs.

Christchurch's commitment to rebuilding post-earthquake has led to the emergence of vibrant communities within these suburbs, providing a ground for property investment while ensuring access to quality education and lifestyle.

Being popular for University of Canterbury and great schools in the country, some suburbs are very close to the central city making it ideal for people who want to invest close to the city and the airport.

Best Christchurch suburbs to Invest in 2024 are:

South of Central City:

Spreydon

Somerfield

Sydenham

West of Central city

Burnside

Avonhead

East of Central City:

Dallington

Saint Albans

Good Nearby Schools

Cashmere High School

Burnside High School

Shirley Intermediate

Avonhead Primary School

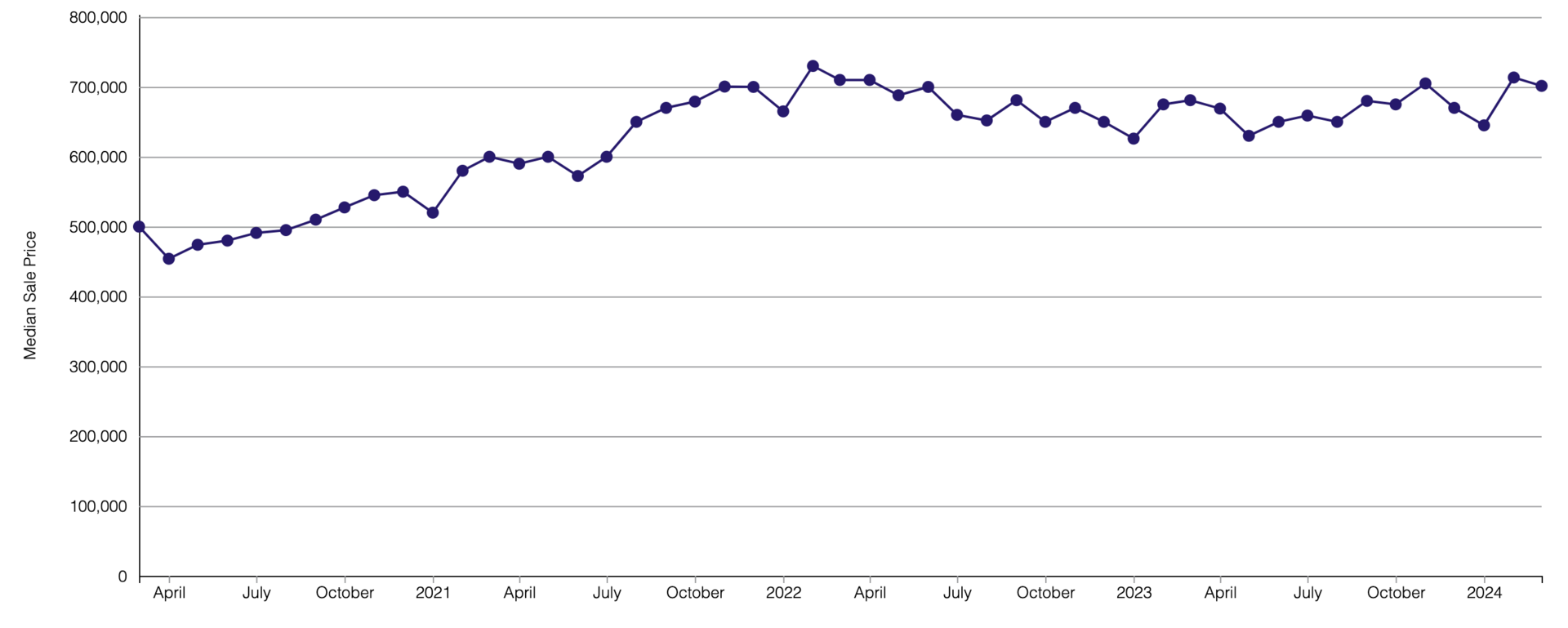

Average House Price Median NZ

Recreational centers and amenities nearby:

Major Supermarkets

Christchurch Airport within 20 mins

Botanic gardens and Hagley park

Riverside Market and Tourist Attractions

New upcoming Sports Stadium

Museum and art galleries

These suburbs provide a balance of affordability and potential for capital growth. They also offer excellent school zoning, such as Cashmere High School and Burnside High School. Investing in properties within these suburbs can be a smart choice for long-term wealth-building.

Christchurch in short is a fantastic place to invest in property, especially in late 2024, or early 2025. As New Zealand is in a recession at the moment my prediction is wait for the trough to buy your next property and always do your research. Also if you have any questions feel free to reach out.

Purchasing an investment property requires careful planning and consideration. By focusing on capital gain, having a long-term plan, and avoiding common mistakes, you can make smart investment decisions. Christchurch offers several suburbs that are worth exploring for investment opportunities. Remember to educate yourself and make informed decisions based on your financial goals. If you have any further questions, please feel free to reach out. Happy investing!

If you would like to discuss the real estate market, please contact us here

or book a Free Property Appraisal

Q: When should I buy my next investment property?

A: The best time to buy your next investment property is during a trough in the real estate market. A trough refers to the coldest state of the market, where prices are at their lowest. Based on my research and analysis, I recommend considering the last quarter of 2024 or the first quarter of 2025 as potential timeframes for your next investment.

Q: Are townhouses a good investment?

A: Generally, townhouses are not the best choice for your first or second investment property. Townhouses tend to have limited potential for significant capital growth. It is advisable to focus on purchasing standalone homes that offer better prospects for appreciation.

Q: Is it important to educate myself before buying an investment property?

A: Absolutely! Educating yourself is crucial when it comes to making informed investment decisions. Take the time to read books and learn from experienced investors. Some recommended books include "Rich Dad Poor Dad" by Robert Kiyosaki and "Money Master the Game" by Tony Robbins. By gaining knowledge and understanding the real estate market, you can make decisions that align with your financial goals.